If you are not syncing with QuickBooks Online, you have the ability to configure Tax Rates within MediaOS.

Please note: MediaOS does not recommend auto-invoicing emails if you are needing tax and connected to QBO. QBO handles all taxes so we recommend letting the invoices get created, sync and then send out the invoices in a manual batch.

Creating a New Tax Rate

- Select your profile avatar in the bottom left-hand corner of the screen.

- Click System Settings from the dropdown.

- Scroll down to the Accounting section and select Tax Rates.

- Click the Add Tax Rate button.

- Name your Tax Rate.

- Set the percentage.

- Click Save.

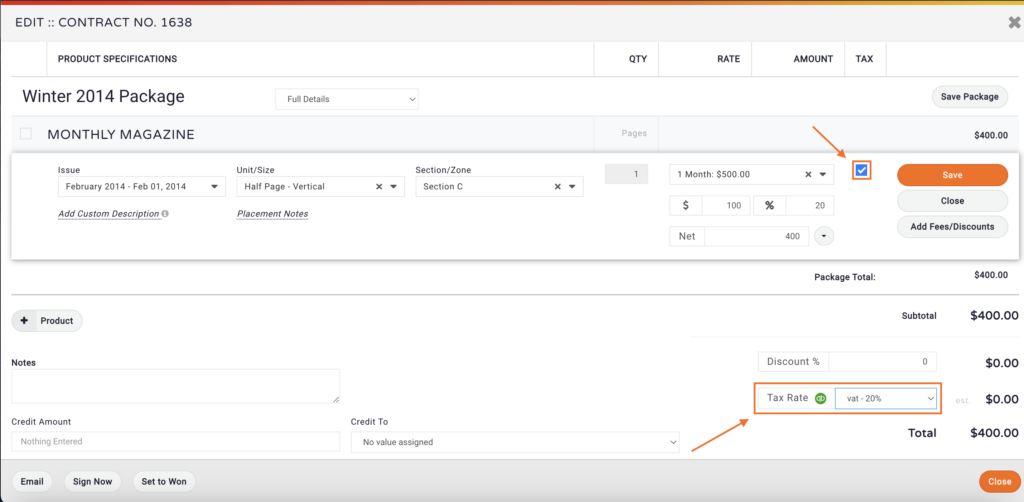

Once you've configured a Tax Rate in your MediaOS account, you will find a Tax Rate dropdown on your proposals. In addition to the dropdown, you will have a Taxable column on all your proposal line items. If the line item is taxable, then click the Taxable checkbox, so that tax is applied to the contract.

- Select the Tax Rate from the dropdown

- Specify which line items are Taxable.

If you are synced with QuickBooks Online, you will need to map your Tax Rates from QBO to MediaOS by following these steps:

- Select Products from the navigation menu.

- Click Manage next to the Product you need to map a tax code to.

- Then, click Edit on the Product Page.

- Click on the Quickbooks Tax Code field and choose the correct tax code for the product.

- Click Save.

- Once your Tax Code is mapped, you will have the Taxable column on all your proposal line items. If the line item is taxable, then click the Taxable checkbox, so that tax is applied when the invoice is created.

Note: When you are synced with QBO the Tax will not be applied until the invoice is created. That being said, it is encouraged to include some verbiage on your contract to indicate that tax is not included.